Tobacco Tax Reform in India: Centre’s New Excise Changes Explained

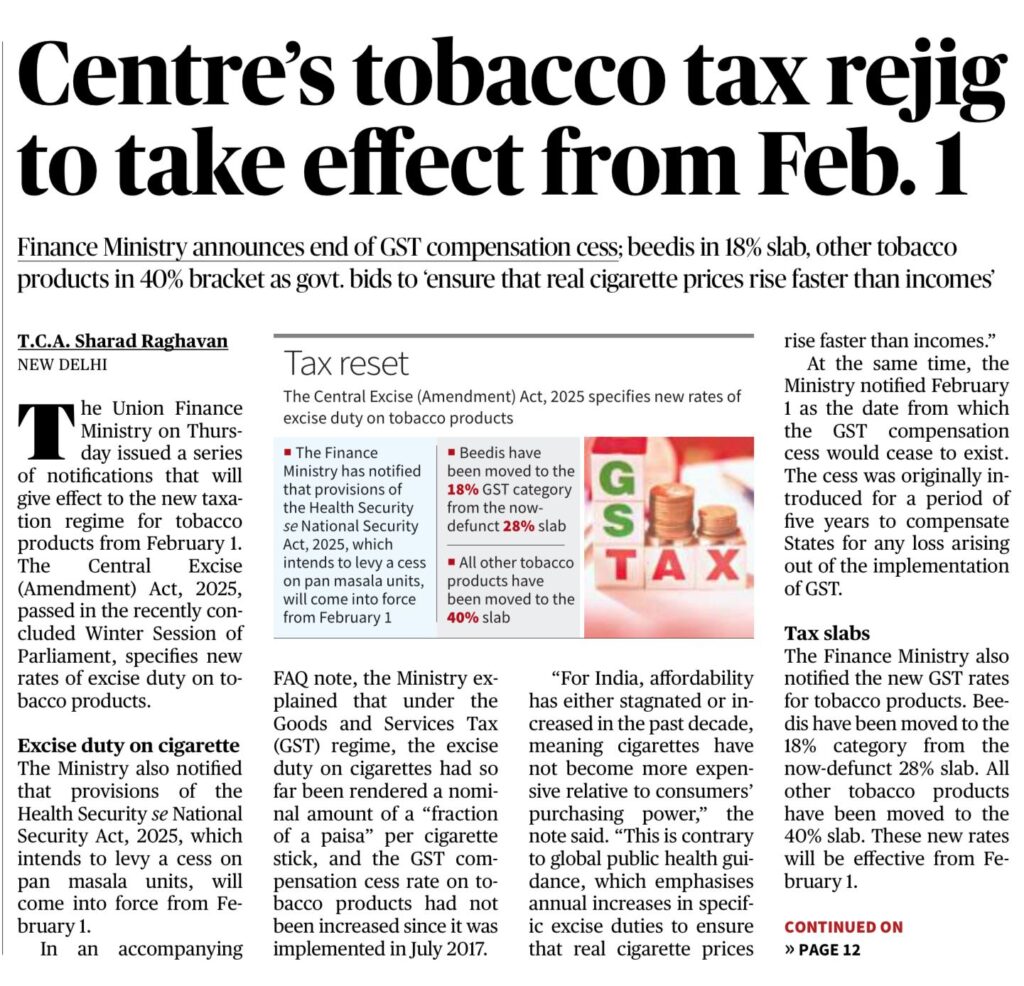

The Tobacco Tax “Reset”

Context

- The Union has passed the Central Excise (Amendment) Act, 2025 and the Health & National Security Cess Act, 2025.

- These laws restructure tobacco taxation to replace the temporary GST Compensation Cess which expires on February 1, 2026.

UPSC Prelims Cheat Sheet

Constitutional Source

- Article 246A: Grants concurrent power to both Centre and States for GST

- Entry 84 (Union List): Gives the Centre exclusive power to levy Excise Duty on tobacco (tobacco is among the few items under both GST and Excise)

- Article 270: Proceeds of GST and Excise are shared with States (Divisible Pool)

- Article 271: Proceeds of the National Security Cess go solely to the Consolidated Fund of India and are not shared with States

Key Structural Changes

- Cigarettes & smokeless tobacco

- Permanent 40% GST slab

- High specific excise duty (tax per 1,000 sticks)

- Beedis

- Moved to lower 18% GST slab (from 28%) to protect workers

- Still subject to excise

- GST Compensation Cess

- Officially ceased (abolished) from February 1, 2026

Administrative Reform

- Capacity-based levy for unorganised sectors (pan masala)

- Tax calculated on machine speed (pouches per minute) instead of self-declared sales

- Objective: curb tax evasion

Policy Goal

- Align with WHO guidelines

- Ensure tobacco prices rise faster than income growth (negative affordability)